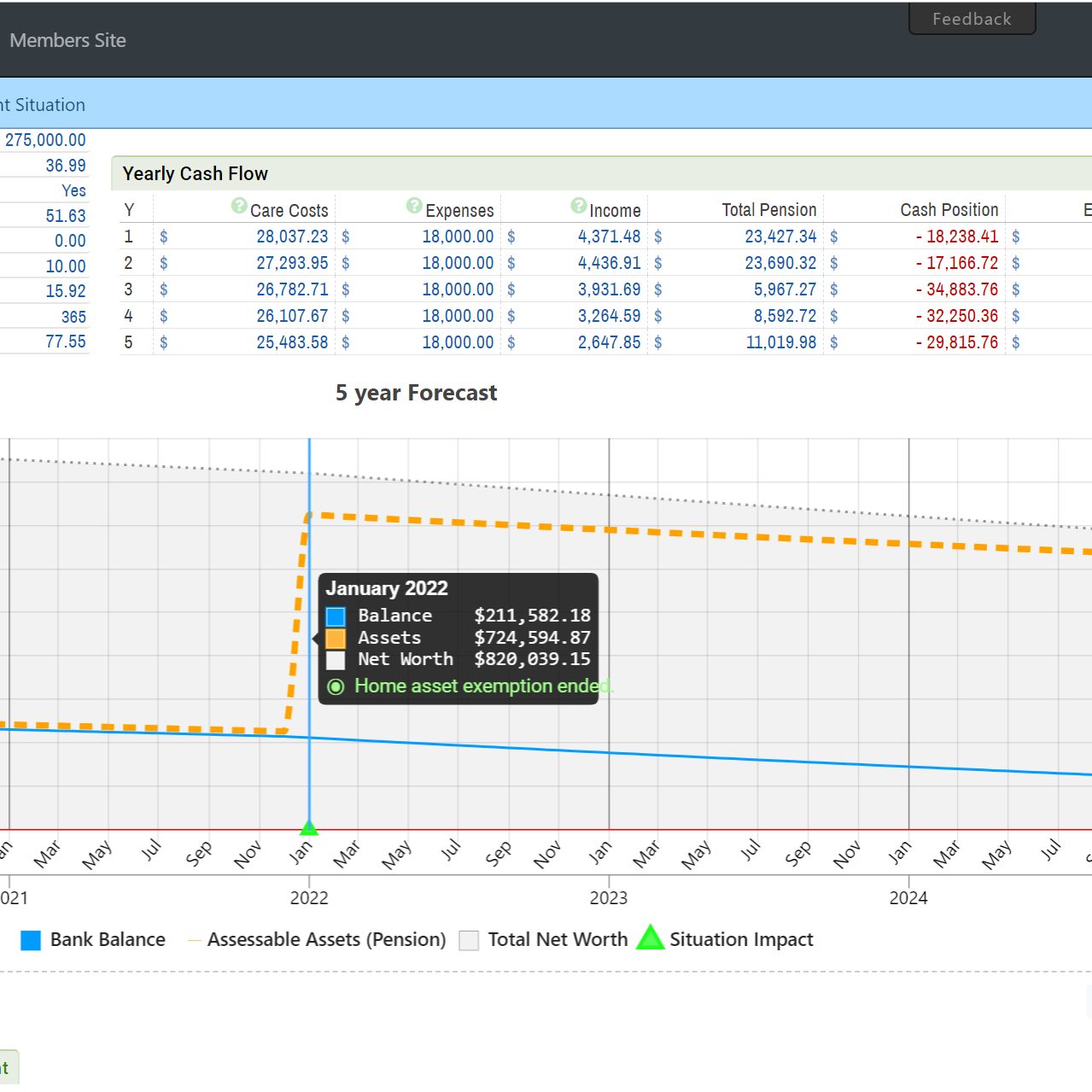

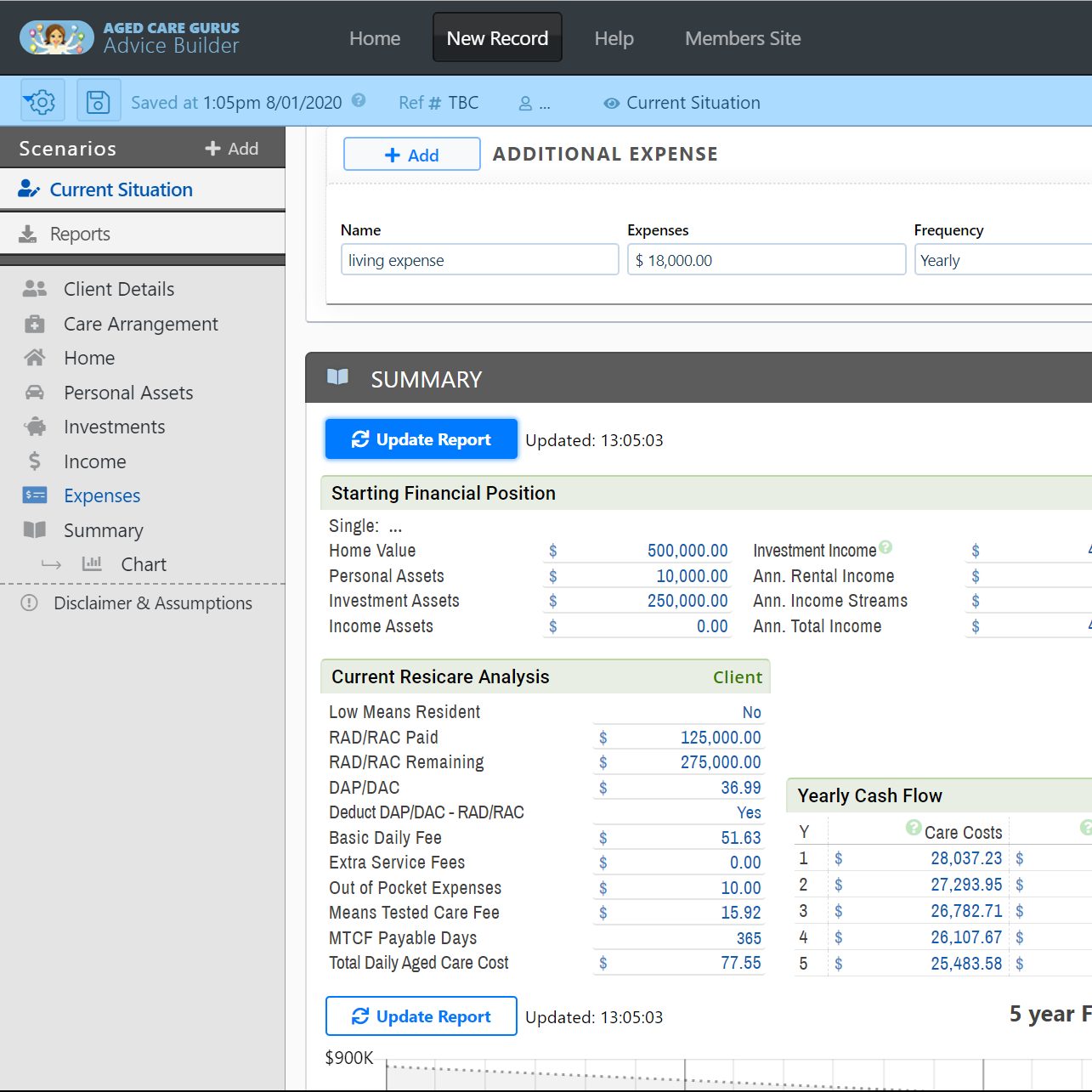

The ACG Advice Builder is simply powerful software which enables you to instantly calculate and deliver quality advice across a range of pension entitlements, homecare, retirement villages, residential aged care and more.

Across our Technical, Advice and Marketing libraries you will find everything from factsheets, SoA wording, articles, checklists, presentations and marketing materials to help you develop strategies, implement advice and promote your business.

Our range of workshops and webinars are designed to enable advisers to start their journey, upskill in new areas and undertake continuing professional development across the spectrum of Aged Care Advice.

The Retirement Living and Aged Care Specialist designation recognises advisers who have the skills, knowledge and tools to deliver quality advice on retirement living and aged care.

The ACG Advice Builder is simply powerful software which enables you to deliver quality advice across a range of pension entitlements, home care, retirement villages, residential aged care and more.

Across our Technical, Advice and Marketing libraries you will find everything from factsheets, SoA wording, articles, checklists, presentations and marketing materials to help you develop strategies, implement advice and promote your business.

Our range of workshops and webinars are designed to enable advisers to start their journey, upskill in new areas and undertake continuing professional development across the spectrum of Aged Care Advice.

Whether you’re keen to learn more about Residential Aged Care, Home Care, Retirement Communities or Granny Flats, we have the workshops and webinars for you.

The Retirement Living and Aged Care Specialist designation recognises advisers who have the skills, knowledge and tools to deliver quality advice on retirement living and aged care

As a Retirement Living and Aged Care Specialist you have an industry recognised accreditation which your colleagues, referral partners and clients can trust.